It feels as if the world has fallen off the cliff with COVID-19 changing overnight our behaviours, decisions and choices.

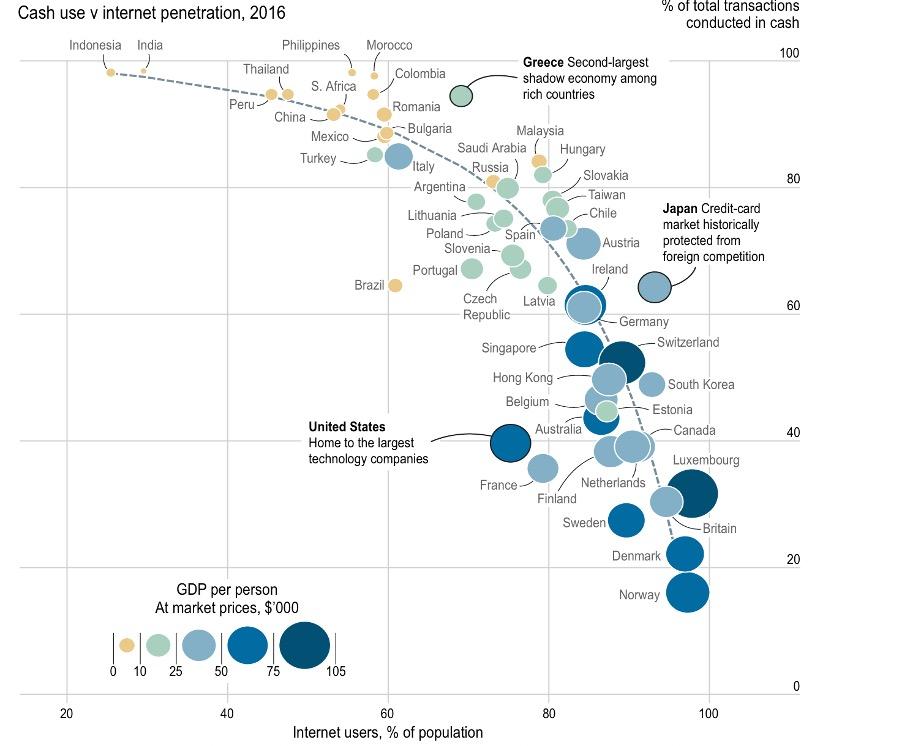

In fear of contracting and spreading pandemics we are turning our backs on “dirty” cash, contaminated with germs and viruses to contactless shopping [1]. Are we transforming into a cashless society [2]?

This wouldn’t be surprising perhaps, as humans have a long-standing experience of barter trade since 6000BC with coins introduced around that time [3]. However this time, instead of bartering – exchanging goods and services, we trade digital information.

So what is cashless and what might our future look like? We don’t have to speculate too much with Finland, Sweden, China, South Korea and UK moving towards cashless society by 2022 [4].

If we were in Sweden , our wallets would be replaced with biometric chips implanted beneath our skin, rendering pickpockets jobless. We would access our homes, offices, gyms, e-tickets, etc. with one swipe of the hand against digital reader [5][6].

Living in China, we would receive salary in digital currency [7][8]. We would shop in unmanned stores and use QR codes to purchase goods in farmers markets. We would eat in waiter-less restaurants – book table, order food and pay bill through the same mobile application [9].

Or, like in Finland, our asylum seekers would receive cards where every transaction is recorded and controlled by immigration officials [10].

Does cashless remove money from circulation replacing it with plastic cards or … with blockchain technology? The beginning of this journey seems rather clear, the finish line however may look a little bit blurred.

As this race stealthily progresses, multiple companies have been ready for us – the customers.

Did you know that Microsoft, KFC, Expedia, Subway and many others have been accepting payments in bitcoins [11]?

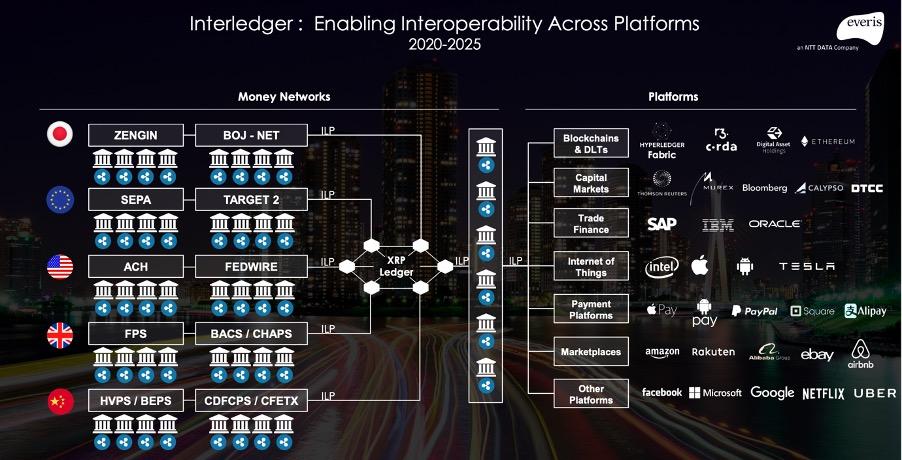

Have you heard that Visa’s crypto card (launched in Singapore in 2018) has been making its way to 530 million people around 31 countries [12]? That FinTechs and banks have been developing blockchain based products and digital currency [13]? That Google collaborates with Citibank to develop their own version of pay card, whilst Facebook works on setting up Libra (a global payment system) [14][15]?

If you don’t wish to touch dirty money , fear no more [16]. A suite of blockchain options is on the go to remove this problem off your hands (no pun intended) [17].

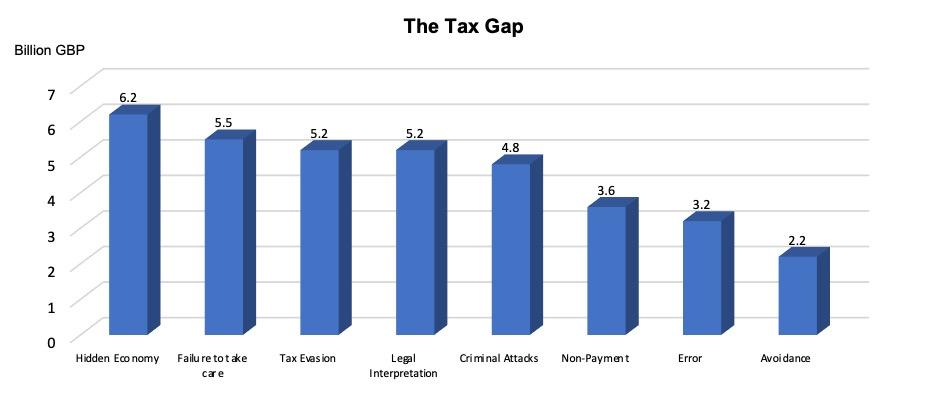

Cashless transactions are easily traceable and designed to remove many threats e.g. the unsubstantiated pandemic spread, tax avoidance, frauds, robbery or illegal immigration that thrive upon cash payments [18][19].

The benefits are countless from speed, convenience and efficiency to reduced cost (cash production, implementation, adaptation, transporting, maintenance, replacing and finally eliminating errors of cash processing).

To put things into perspective, we are looking at £36 billion of theoretical savings (6.5% of expected tax liabilities) in the UK only [20].

Will we – the oridinary customer, the “small” taxpayer benefit from this potential wealth?

Despite the possible benefits, there seems to be a perception that cashless society is driven by the desire to exert maximum economic and social control.

Why would that be?

Is it because we lost confidence in the banking system after financial crisis in 2009 with little ownership and accountability being held?

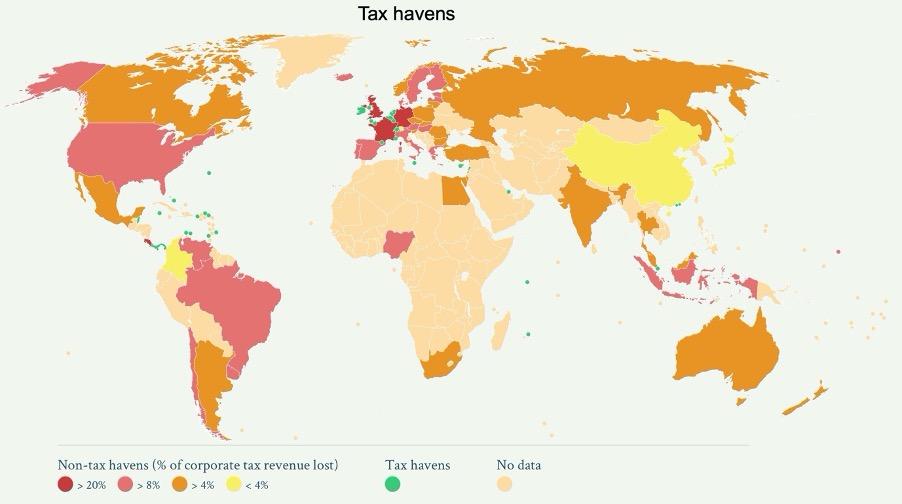

Or due to insufficeint trust in public authorities to design fair policies, whilst watching the wealthiest to shift their fortunes to tax havens (over $700 billion in 2017) [21][22][23][24]?

Or is it perhaps we don’t believe the media in their frenzied pursuit of misinformation?

As we shift toward digital society, have we asked all THE questions and mapped all possibilities?

Have we thought of impact of cashless society on approx. 1.7 billion of people without bank accounts (2 million in UK , 32 million in USA ), the homeless, the vulnerable, the victims of domestic abuse hiding money away, etc.[25] [26]?

Living in a complex, global ecosystem how do we intend to handle trade and tourism with countries where cash is still king [27]?

Have we considered technology and system issues:

If you were responsible for managing a shift towards cashless society, if this project (having an impact on your bottom line) was undertaken by your organisation, how would you manage it?

Can we influence our authorities to follow the best practices in managing this change?

Appius Claudius Crassus Caecus [35] (statesman, censor and consul of the Roman Republic [36] 340-280BC) summed it up best this way – we are the architects of our own fortune. He knew it, as it was Romans who built the first, sophisticated banking system.

A system which even then was known to widen the social gap, accentuating inequalities between people [37].

It is not a matter of “if” but “when” the cashless society becomes a reality.

Whilst we may disagree on how it should look like, we ought to agree on questions to ask right now in order to architect a win-win, 21st century system with the grass greener on all sides.

If you enjoyed reading this blog, feel to share it and follow us on @SimplarityUK.

Copyright© 2020-2024 Simplarity Limited